What's Better: AI-enabled services or AI-SaaS?

OffDeal (YC w24) shows that there's money in services everywhere

Each month, this newsletter is read by over 45K+ operators, investors, and tech / product leaders and executives. If you found value in this newsletter, please consider supporting via subscribing or upgrading. This helps support independent AI analysis. If you are technical, looking for new opportunities, and want to connect, my DMs are open on Substack.

Recently, Financial Times wrote a viral article about OffDeal (YC w24), a self-proclaimed AI-native investment bank that helps large SMBs and franchises sell to Private Equity firms.

Why did the article go viral? Apparently, OffDeal’s doing so well, that its 25-year-old associate made a $2 million bonus—more than most MDs on Wall Street. This also left many junior bankers and VCs questioning their life choices.

So what does OffDeal do? Say you are a regional nail salon chain owner doing $5m/yr, and you want to sell and retire. Instead of just selling to the first PE associate or a recent HBS grad that calls you, you want price discovery. The solution? OffDeal (supposedly) gets you 20%-40% higher price by getting you more bids.

OffDeal’s story is interesting, because it urges revisiting the timeless question in vertical AI: is it better to sell services (“AI-enabled service”) or the shovels (“AI-SaaS / Agents”)?

Many think that the answer is to start “Cursor for X” (my previous coverage). But OffDeal did exactly the opposite: it pivoted away from selling SaaS to selling services to capture more value.

In fact, OffDeal’s success (so far) demonstrates that full-stack AI-enabled services may be a better way to make “real” money in white-shoe industries like banking or accounting. For investors, it shows tech-enabled roll-ups need not be the only way to enter vertical AI markets, since OffDeal didn’t buy an I-Bank to get started.

That said, AI-enabled services have their unique challenges, and require a very deliberate execution strategy, as highlighted by OffDeal’s trajectory. Otherwise, the company is just a glorified agency or a dev shop.

Plus, the window for starting and scaling this business will close over the next year, as “AI-native best practices” disseminate. The term “AI-enabled service” itself is a misnomer, given that all service business in the future will be heavily AI-enabled.

So the question is: how fast can you expand your AI-enabled service business, before the “arbitrage” of having less overhead than the incumbents runs out of juice? Is there any defensibility?

In this post, I’ll talk about:

How an AI-enabled service works, through the lens of OffDeal.

Whether or not OffDeal (and AI-enabled services) has long term defensibility.

How you can plausibly fast-follow what OffDeal is doing.

The pros and cons of starting an AI-enabled service, versus starting “Cursor for Mid-Market Investment Banks”, “AI CRM for Doggy Day Care”, etc.

and the key challenges of AI-enabled services vs AI-SaaS.

How AI-Enabled Services Work

So what exactly is an “AI-enabled service”? While AI-enabled service sounds like a ground breaking idea, it really isn’t.

For one, AI-enabled services are already everywhere around you. It’s just a question of how committed you are culturally to maximizing automation in your firm.

Case in point: most web development agencies are arguably AI-enabled services, in the sense that AI coding agents already output 70%-90%+ of all final output.

But to do “AI-enabled service” correctly, the company has to be culturally rebuilt from ground-up to leverage AI in a maximal fashion: every process, no matter how mundane, will be built with automation and straight-through-processing (STP) in mind.

Canonical examples:

Instead of giving sales reps SaaS tools to do outreach, an AI-native firm delegates lead gen to agents, hooked up to real-looking email and social accounts. End customers have no idea Amy is an AI bot replying from

amy@your-company.com.instead of having a banker create a pitch deck by spending 100 hours on each deck, AI generates it in 10 minutes, and the banker just does minor tweaks. Considering each analyst or associate “costs” $200K-$350K a year, the savings are self-evident.

Basically, it’s a firm that’s designed from the ground up to “default assume” work is mostly done with AI, while human efforts are also repurposed to tasks that 1) require human input or judgement, or 2) finding new automation opportunities.

The most important benefit of AI native design is leverage. There’s a massive difference between an AI-injected business that has 30% of the company running in a human-heavy fashion, versus a company that figured out the “last mile” of automations.

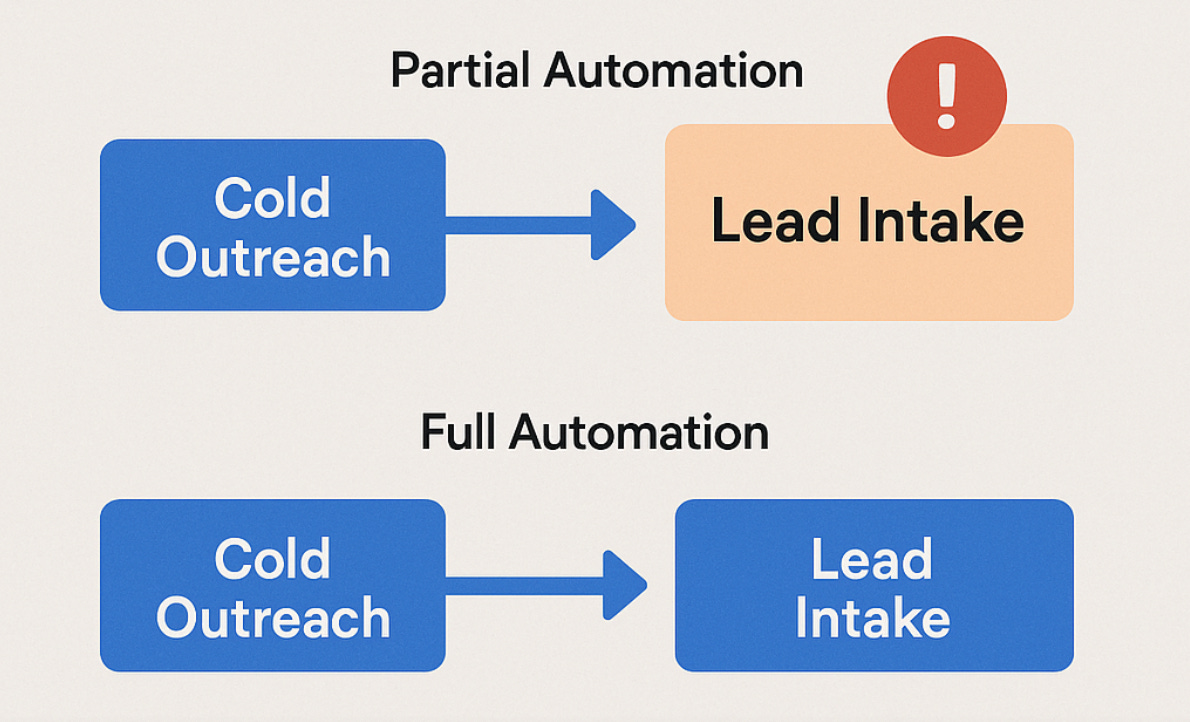

Full automation is necessary, because whatever you decided NOT to automate will end up being the bottleneck. For example, if you automated cold-outreach process but not lead intake, then you will have issues with triaging leads.

The latter will simply kill the former in customer acquisition, operations, and service delivery (until the arbitrage runs out) - all else equal.

Thus, in OffDeal’s case, they aren’t just automating the outreach and lead gen, but the whole firm.

Deal sourcing: done through an internal leads (of SMBs) database that allows for its deal sourcing agents to automate most of outreach. Humans are involved for setting search parameters, improving agent performance, and designing guardrails.

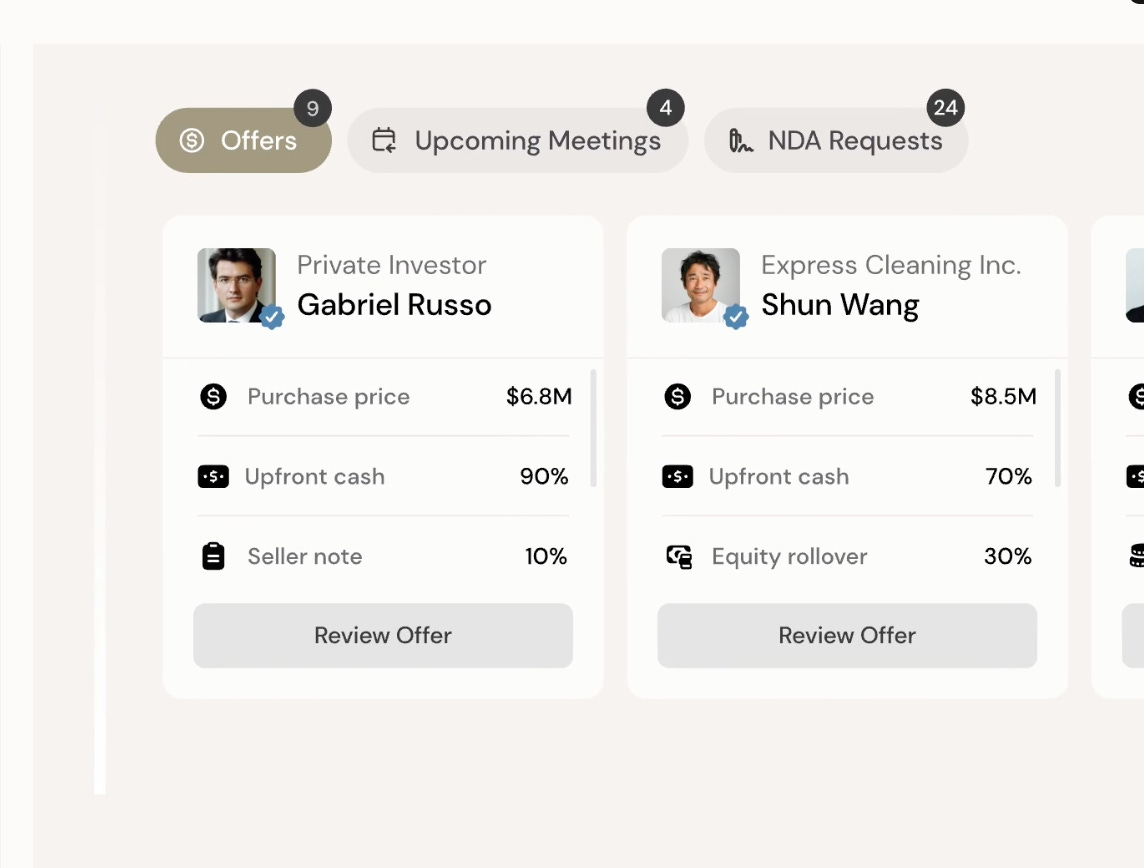

Pricing and deck generation: sellers are able to get faster pitch decks and valuation ranges. Think of how Zillow created Zestimates to induce buyers and sellers to come. With AI automation, OffDeal is able to provide just that, unlike other boutique investment banks that make sellers wait for days (or weeks) to get an appraisal & pitch deck.

Examples of point solutions in this space: https://www.context.ai/

Basic compliance, email, document automation: simple document automation for doing rote compliance and contract review. This enables “contract signed” event to trigger “send invoice” event, allowing you to do with a tiny back office.

Now, is OffDeal “really” fully AI-native, or is there some marketing hype to this? Exactly how automated is OffDeal? Is it all smokes and mirrors?

Some “AI-enabled” services in the past got busted for hiring Indian BPOs for doing most of the “AI” (like builder.io), and some AI companies like icon.com openly admit that their processes aren’t really AI. Of course, they still got funding at “agent” valuations!

But OffDeal’s more automated than the regional boutiques IBs (its competition), and that’s what matters.

Simultaneously, none of this is truly ground breaking. We all know automation is hitting, and the “arb” is in incumbents being slow at ripping out their org charts to eliminate waste in their ops.

The more interesting question is:

how did OffDeal carve out a niche in a “white-shoe” industry like banking?

does OffDeal have any defensibility?

how would one go about replicating OffDeal?

The Evolution of OffDeal’s Strategy

OffDeal started out in 2024 as a SaaS tool provider for search funds. Then sometime in 2024, they realized there’s more money in using their own SaaS to commit to service (by becoming an investment bank).

So why did they do that?

🚀 I am officially launching AI Native Firm to help companies and PE firms with AI strategy. I have been informally doing consulting for tech leaders (and doing workshops) for the past year, and wanted to formalize some services offerings.

Many companies are 1) building the wrong things in the wrong way, 2) struggling to identify AI opportunities, and 3) making the wrong build vs buy decisions, getting picked off by vendors. If you are a business and this resonates with you, contact us to get a fresh pair of eyes.