OpenAI can't beat Google in consumer AI

And it's not because of Gemini 3

Black Friday Sale (20% off) Announcement.

Claim a 20% discount for paid content and archive access on the annual plan, including my predictions for 2026 (coming soon) and tech commentary. Each month, this newsletter is read by over 45K+ operators, investors, and tech / product leaders and executives.

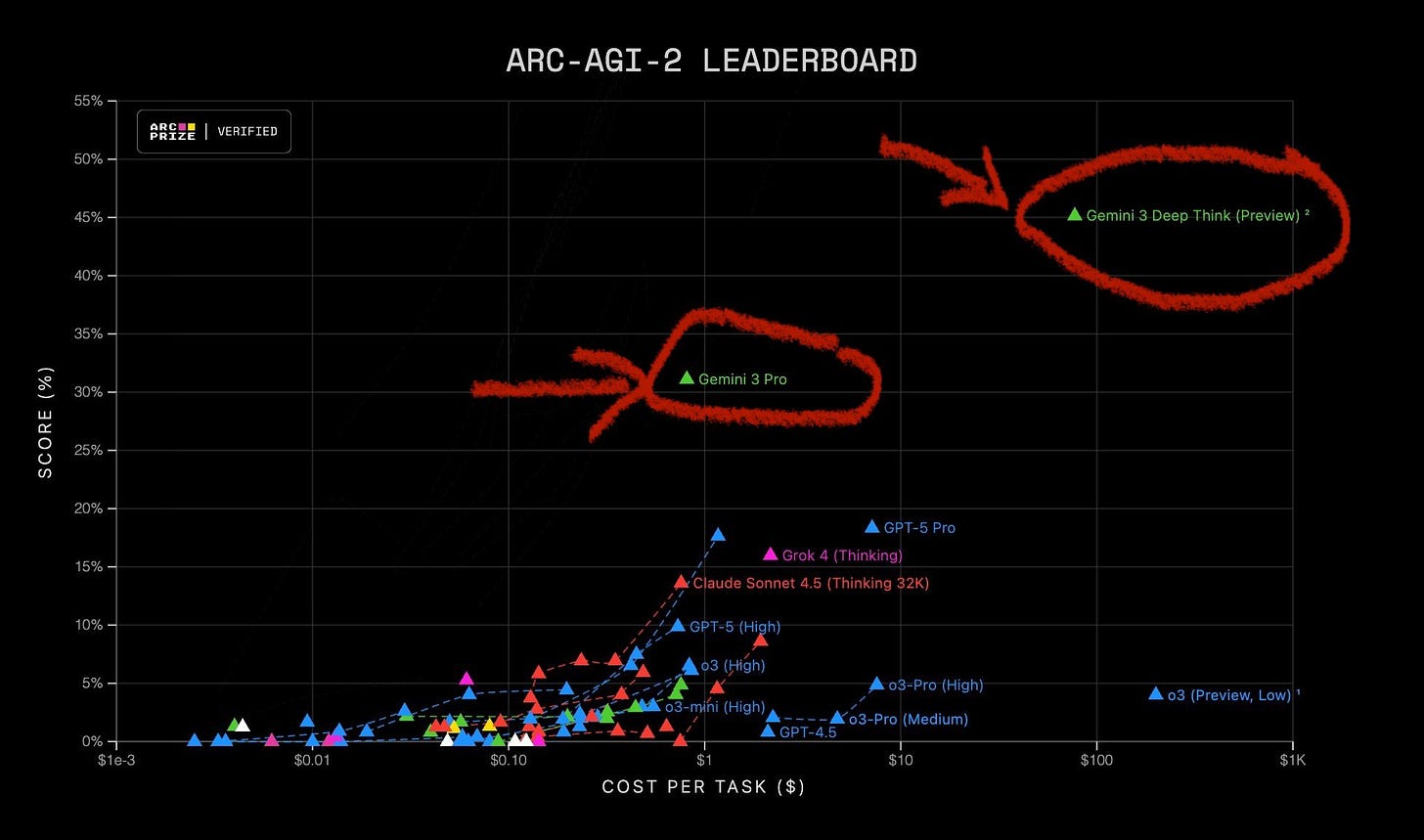

Yesterday’s Gemini-3 release by Google has major competitive implications, so I wanted to put out a quick note and walk through my takeaways from Google officially retaking the pole position in the model race.

TLDR:

OpenAI can’t beat Google at consumer AI, as long as we are in the “chatbot” paradigm. Clock’s ticking for OpenAI to pull a rabbit out of the hat asap (in December). It’s worrisome that OpenAI’s best effort at front-running the Gemini 3 release was with GPT-5.1, which was barely an improvement. Most importantly, Google has much cheaper inference COGs than OpenAI due to its vertical AI integration (with TPUs) and scale. That allows Google to commoditize whatever OpenAI puts out, making monetization impossible.

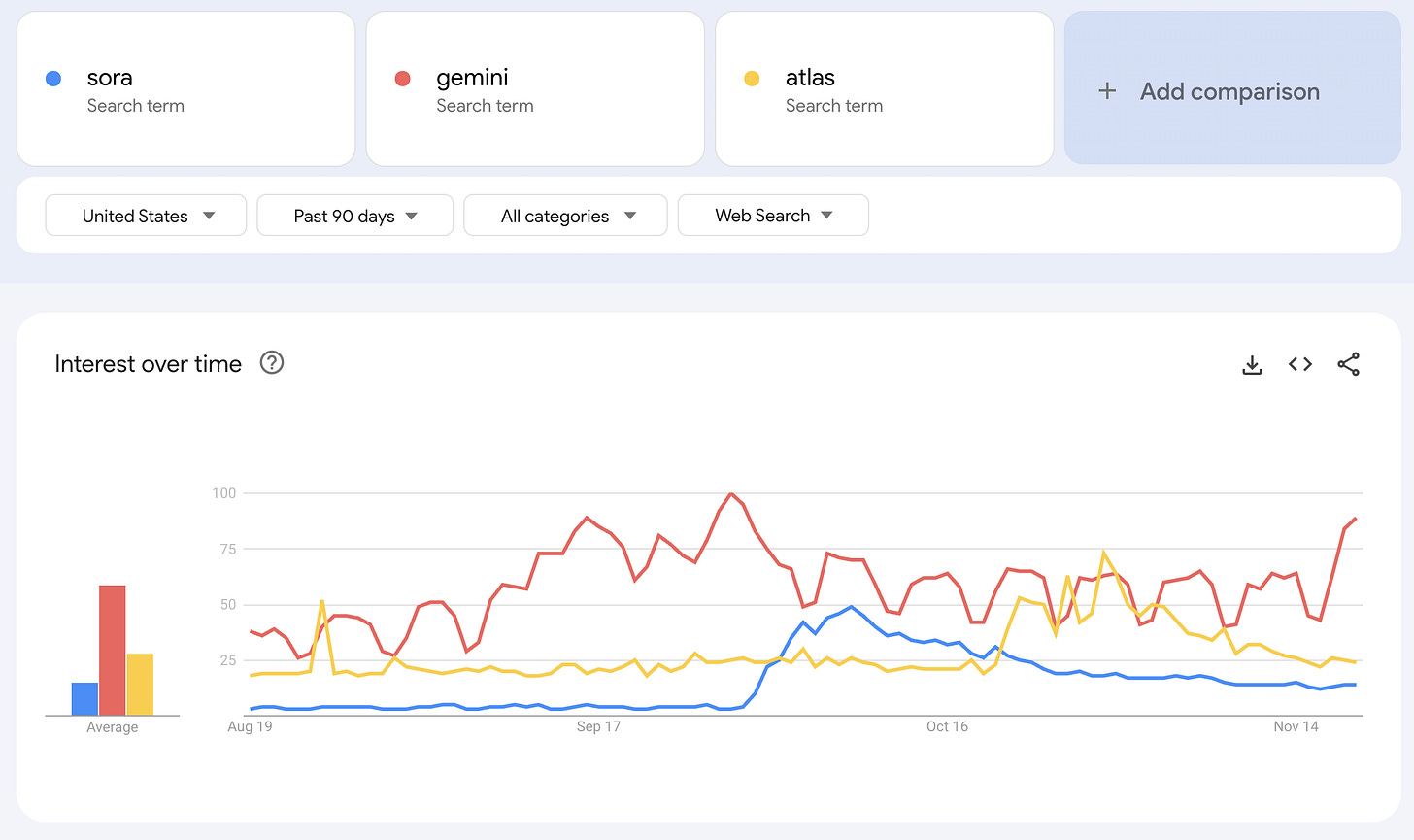

Recent OpenAI launches aren’t doing well (e.g. Sora, Atlas browser, commerce partnerships), etc. ChatGPT has been losing marketshare all year. More in the footnote. Atlas browser’s nice, but quite buggy. Sora is too niche. OpenAI is better served by focusing on building productivity apps and enterprise AI - it can still build a trillion dollar company on that. I guess it’s about moonshots.

OpenAI needs new form factors aside from chatbots to drive incremental growth. If we are in the chatbot paradigm, we are stuck in the current equilibrium. Need to change the paradigm.

Google’s data advantage, especially in multi-modal, is really shining. Because Google’s so strong in multi-modal, Gemini 3 just destroyed Sonnet 4.5 in frontend UI coding (which is a visual task). Little things like this makes Google hard to beat, because OpenAI can’t synthetically generate every type of data for training, e.g.Youtube or Google Maps.

Little advantages like Google maps and gmail add up. It hit me the other day, that ChatGPT can’t answer questions based on Google Maps data, which is a crippling disadvantage. Maps alone makes Gemini a winner over ChatGPT (which uses Apple maps) in terms of acting as a personal assistant.

Google’s dominance may come at the expense of the Nvidia ecosystem and Neoclouds, and perhaps Nvidia itself. But Jensen Huang knew this will happen, hence his frantic vendor financing dealmaking since September to secure demand out to 2027. Because Jensen acted ahead of the curve, the damage will be contained. On a relative basis, Google to outperform Nvidia from here.

Google winning too much, too soon might be bearish for AI capex, and AI progress, long term. That said, no one’s giving up any time soon, and AI capex plans will be unaffected for at least a year. Since Google just proved that there’s still juice left in squeezing pre-training and RL, it’s doubtful that OpenAI or Anthropic change its capex plans anytime soon. If anything, all this proves that Sam Altman was right all along that he needs $1.4 trn for data center commitments, just to keep up with Google.

Frontier model API prices probably won’t go any lower from here, just like object storage prices. What’s interesting is that Gemini 3 API prices are higher than GPT-5.1, indicating that Google’s ditching its lowest-cost pricing strategy and going premium. It’s unlikely that OpenAI or Anthropic will undercut Gemini 3 in the future, given their margin pressures.

The first to flinch on AI capex will (hopefully) be Meta, which will make the stock rally. However, Meta is looking at long term stagnation either way, considering it’s not a vertically integrated AI company. I wrote before that Meta has no business spending $90bn on capex for 2026.

Google seems confident about its model superiority, since it just let Anthropic partner with Microsoft to serve Claude models on Azure.

Microsoft and Amazon are at the risk of losing the largest AI workloads, if a significant gap emerges between Google and OpenAI / Anthropic. Microsoft is more negatively exposed than Amazon to Google’s dominance, since Copilot 365 overlaps too much with Google Enterprise. GCP to gain marketshare faster.

Footnote

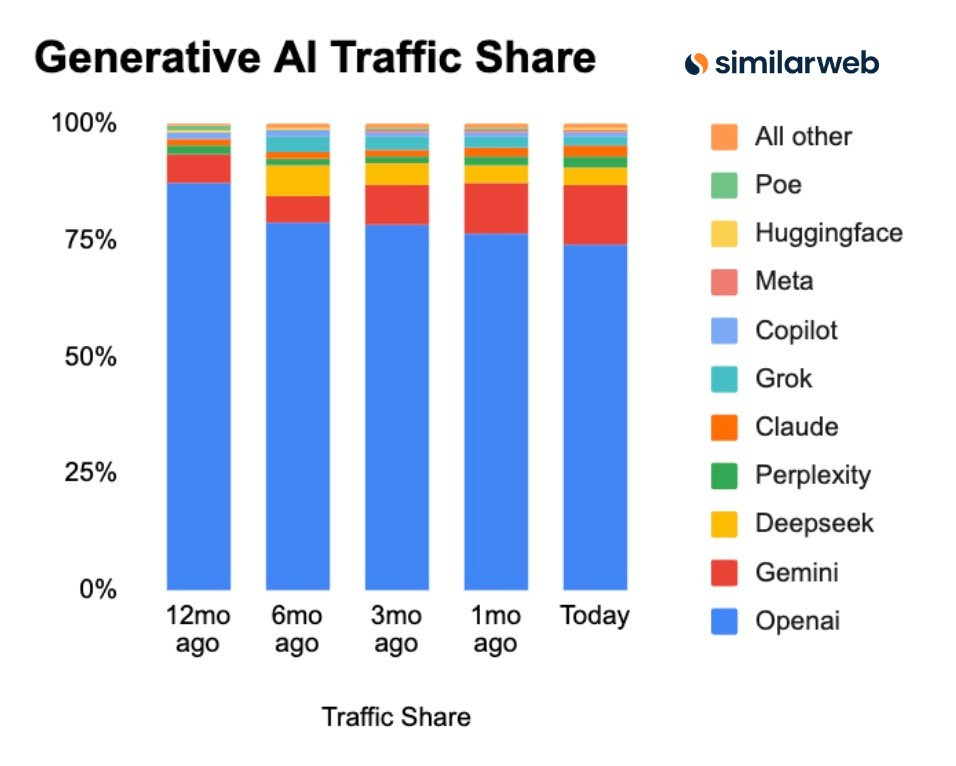

OpenAI is losing market share in the chatbot space, and session durations have plateaued. This was getting increasing apparent since September, but the release of Gemini-3 seals it. Note, ChatGPT’s chatbot marketshare has dropped from 87% → 73% since the beginning of 2025.

In the consumer space, OpenAI, as the upstart, needs a durable, meaningful model advantage to pry consumer attention away from Google (and Meta). Attention is finite. If OpenAI can’t maintain a clear performance gap — or if Google can now fast-follow anything OpenAI ships — then OpenAI loses its edge.

But OpenAI’s lead in models shrank from 6 months in 2024 to perhaps zero as of November 2025. I believe this strongly correlates with OpenAI’s market share decline. It doesn’t help that OpenAI’s latest launches (e.g. Sora) haven’t sustained viral growth weeks after its launch.

Looking ahead, without a lead in models, OpenAI can’t expand its DAUs, which is ultimately ad inventory. Meanwhile, Google and Meta not only control far more ad surfaces than OpenAI does—they’re also vastly better at monetizing them. That dynamic puts OpenAI in a tough spot: almost like it’s stuck swimming in place while the incumbents close in.

About Me

I write the “Enterprise AI Trends” newsletter (read by over 45K readers worldwide per month), and help companies build the right AI solutions.

Previously, I was a Generative AI architect at AWS, an early PM at Alexa, and the Head of Volatility Index Trading at Morgan Stanley. I studied CS and Math at Stanford (BS, MS).